With the emergence of new companies and the rapid creation of startups, financing options have expanded to empower businesses’ development, operation, and functioning. Among the most popular ones are:

Financing through bank loans.

Startups can also obtain financing through bank loans or other sources of debt financing.

Angel financing.

This type of financing involves investment by private investors, often a group of successful entrepreneurs, who inject capital into a startup in exchange for equity participation in the company. The purpose is to provide expertise in the field where the investors have an expert team to boost the companies. One advantage for investors is that they find higher returns on their contributions since they enter before any other round of venture capital.

Venture capital

This involves capital investment in the startup in exchange for equity participation in the company. Venture capital investors seek high long-term returns through the company’s success.

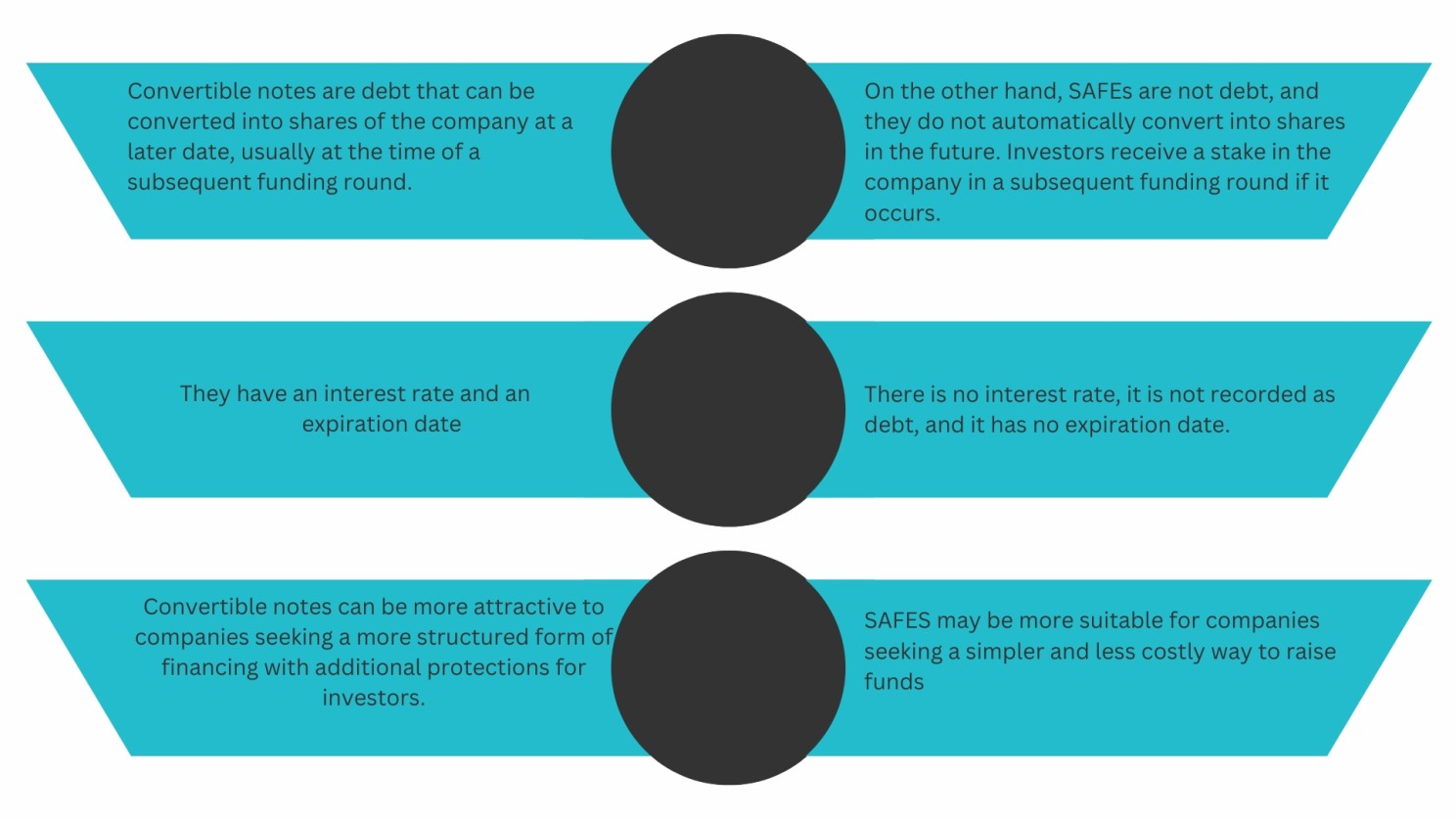

Convertible notes and SAFEs act as hybrid financing of the last two, as investors assume the risk and provide confidence to new projects. However, they also seek returns they will obtain once the company reaches its peak value and excels in the market.

Convertible Notes

Characteristics of the convertible note

Convertible notes are a financial instrument that has gained popularity recently, especially in the emerging and technology sectors. This financial tool combines debt and equity investment features, making it attractive for entrepreneurs seeking financing and investors looking for attractive investment opportunities.

SAFEs (Simple Agreement for Future Equity)

Characteristics of SAFEs

Convertible note VS SAFEs

SAFEs are a financing instrument startups and emerging companies use to raise capital from investors. Instead of offering company shares in exchange for investment, SAFEs allow investors to acquire the right to future claims later.

There is no specific regulation for convertible notes or SAFEs in Mexico. However, financing instruments are regulated based on the Securities Market Law and the tax provisions established in the Income Tax Law (LISR) for any potential tax effects.

Accounting for SAFEs according to IFRS

The basis behind this accounting record is that convertible notes are a complex financial instrument combining debt and capital components. IFRS 9 establishes that companies must classify financial instruments according to their legal form, economic substance, and contractual terms and conditions.

Under IFRS, convertible notes are initially classified as financial liabilities and measured at amortized cost or fair value with changes in fair value through profit or loss if designated at fair value through profit or loss.

Scenarios for accounting for convertible notes under International Financial Reporting Standards (IFRS):

- At the time of issuance of the convertible note, a financial liability would be recognized in the corresponding account for the nominal value of the message. This liability would be composed of the portion of the note that is convertible into shares in the future.

- In the event of such conversion, a capital increase operation would be recorded for the same amount, with a decrease in liability.

- If the investor decides not to convert the note into shares, the disbursement would be recorded in the corresponding account, with the related reserve previously provided to meet the financial obligation represented by the convertible note.

This accounting record is made to reflect the change in the financial structure of the entity, as convertible notes classified as debt at the time of issuance have been converted into shares. Additionally, this conversion will affect the book value of the company and the way earnings and dividends will be distributed in the future.